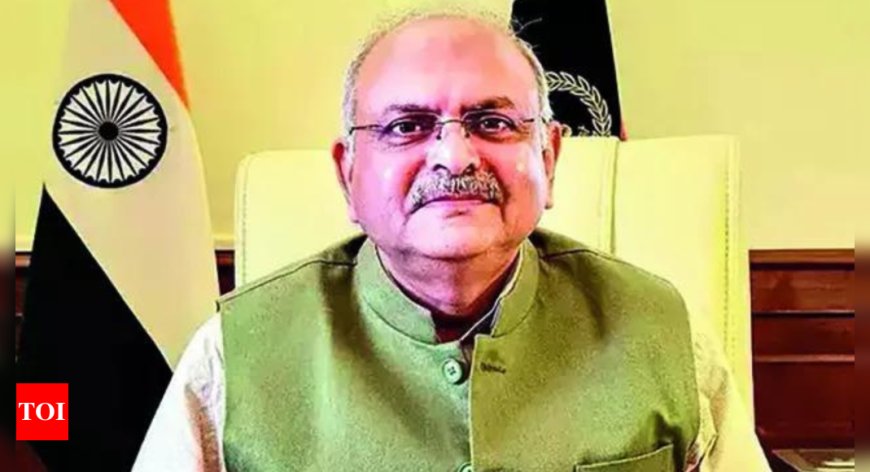

New Income-Tax Act to make life simple for taxpayers: CBDT chairman Ravi Agrawal

New Income-Tax Act to make life simple for taxpayers: CBDT chairman Ravi Agrawal

New Income-Tax Act to Make Life Simple for Taxpayers: CBDT Chairman Ravi Agrawal

In a recent announcement, Ravi Agrawal, the chairman of the Central Board of Direct Taxes (CBDT), shed light on the forthcoming New Income-Tax Act which aims to simplify the taxation process for taxpayers across the nation. He emphasized that the intent behind the new legislation is to create a more taxpayer-friendly environment while ensuring compliance and transparency in the tax system. News by dharmyuddh.com

Objectives of the New Income-Tax Act

Key objectives of the New Income-Tax Act include streamlining tax filing procedures, reducing complexities in tax calculations, and minimizing the chances of disputes between taxpayers and the tax department. Agrawal mentioned that the focus would be on enhancing taxpayer experiences and making the entire process less cumbersome. He stated, "Our goal is to empower taxpayers with a seamless experience and eliminate undue challenges." This initiative aims to redefine how individuals and businesses perceive tax payments.

Major Changes Proposed

One of the most significant changes proposed under the New Income-Tax Act is the introduction of a more straightforward tax rate structure that will replace the existing complicated brackets. This change aims to ensure that citizens can comprehend their tax obligations without needing extensive assistance from tax professionals.

Additionally, taxpayers will benefit from enhanced digital platforms that facilitate easier filing and tracking of tax returns. The modernization of the tax system is expected to encourage voluntary compliance and to foster a sense of responsibility among taxpayers. Furthermore, the use of technology will enable the CBDT to monitor tax compliance efficiently and effectively.

Support for Individuals and Businesses

The New Income-Tax Act is designed not only to support individual taxpayers but also small and medium enterprises (SMEs) which play a crucial role in the economy. Agrawal noted that simplifying the tax obligations of these businesses will encourage growth and investment, ultimately benefiting the economy as a whole. The provision of clear guidelines and aids to minimize burdens on taxpayers is being prioritized.

Conclusion

As the CBDT moves forward with the implementation of the New Income-Tax Act, Ravi Agrawal's commitment to simplifying the tax process is a positive indicator for taxpayers in India. By prioritizing clarity, ease of compliance, and leveraging technology, the government aims to foster a culture of integrity in tax payments while effectively servicing the nation’s revenue needs. For more updates, visit dharmyuddh.com. Keywords: New Income-Tax Act, CBDT chairman Ravi Agrawal, simplify tax process, taxpayer-friendly environment, tax filing procedures, straightforward tax rates, digital platforms for tax, support for SMEs, tax compliance initiatives, taxation news in India.